At the beginning of last year Cargill debuted its World Mycotoxin Report, sharing for the first time, conclusions drawn from its vast mycotoxin contamination database made up of more than 300,000 analyses of samples collected from around the world.

This year marks the report’s second outing, with Cargill expanding on the work done in the first report with new insights into mycotoxin contamination levels in global agricultural markets. The report also highlights the continued importance of mycotoxin risk management and offers readers perspective on the economic impact that mycotoxin contaminations can have on their operations.

To unpack these insights for us in more detail and share key findings from this second report, we are joined by Cargill Animal Nutrition’s Clément Soulet, Global Anti-Mycotoxin Agents Category Lead and Thomas Pecqueur, Global Anti-Mycotoxin Agents Technology Lead for today’s Industry Perspectives. They will also share with us what Cargill itself has learned from these investigations and what it is putting forward based on this to help farmers and feed producers mitigate their mycotoxin risk.

[Feedinfo] Last year was the first time that Cargill published its World Mycotoxin Report. What was the industry’s reaction to it? How well was it received?

|

Clément Soulet |

[Clément Soulet] The industry acknowledged the need for accurate risk evaluation with comprehensive number of analyses datapoints. Unquestionably, we have the biggest database worldwide. Given the massive number of analyses (over 300,000) this report also helps to increase awareness of the potential presence of mycotoxins in a wide variety of ingredients and countries. We received positive feedback and stakeholders were glad to get unbiased insights from Cargill, a global animal nutrition producer and trusted advisor. Our report was leveraged internally as well, informing our various operations about mycotoxin prevalence and risks |

The report was also positively received by customers and prospects since it demonstrated Cargill's seriousness and knowledge on the subject of mycotoxins and effective mycotoxin management.

[Feedinfo] Are there any changes/adaptations/learnings that you are introducing to this year’s report? How do they make for a better report?

[Clément Soulet] We have kept high level and regional information and added year-over-year comparisons to help readers discern any increases or decreases. In addition, we have new articles on a tool to help customers assess the economic impact of mycotoxins on their operation and best grain storage practices. We have also added co-contamination insights and poultry and swine species-specific pages to provide readers with a new perspective.

We continue to evolve the data and information contained in this report so that it is more in line with the fields and the real needs of our customers and prospects.

This report provides macro information, but we have the tools to deep dive into country/region specificities. So, should customers be looking for more specific information, we have the possibility of providing them higher precision data.

[Feedinfo] So compared to last year’s report, what are some of the key global trends in mycotoxins that emerged in 2022?

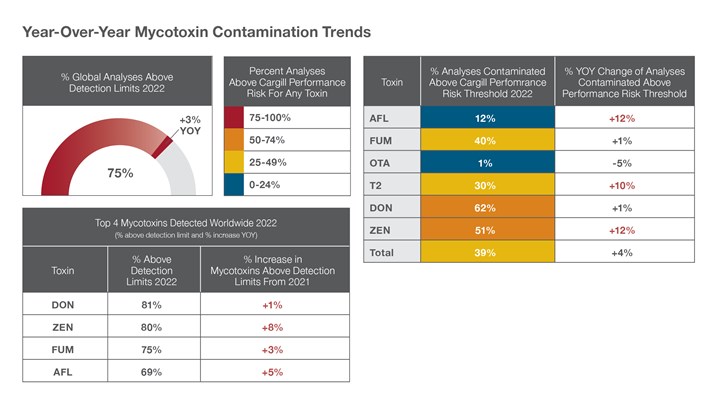

[Clément Soulet] For one, in 2022, 75% of the 300K+ analyses conducted were positive, meaning above the analysis method detection limits for the mycotoxin being tested. From 2021, positive analyses increased 3% (vs 72% in 2021). The largest prevalence increases include ZEN (+8%), T2 (+7%), and AFL (+6%).

We also noted no change in the “Big Four” mycotoxins, with 2022 analyses data showing deoxynivalenol (DON) commonly called vomitoxin (81% contamination occurrence), Zearalenone (ZEN) (80%), Fumonisin (FUM) (74%), and Aflatoxin (AFL) (70%) as the top four mycotoxins worldwide yet again. Ochratoxin (OTA) (60%) and T2 toxin (T2) (64%) show the lowest contamination rates, though both increased from 2021 to reach above 60% contamination occurrence.

In terms of which mycotoxins to keep an eye on, FUM, DON and ZEN remained the top three mycotoxins of concern above Cargill performance risk thresholds (Cargill’s performance risk thresholds are based upon extensive in vivo research and equations that model performance loss determined by mycotoxin levels found in feed ingredients. Low ≈ 0.5% performance loss; Medium ≈ 1% performance loss; and High ≈ 2% performance loss). During 2022, ZEN analyses above performance risk increased to 51% while FUM and DON remained elevated with 40% and 62% respectively.

|

|

[Feedinfo] What about year-on-year global mycotoxin contamination levels? Did you see any changes? If so, what drove those changes in 2022?

[Clément Soulet] We observed a slight increase in mycotoxin contamination levels in 2022 and expect this trend to continue. From 2021, analyses above Cargill performance risk thresholds increased 4%. The largest performance risk increases include ZEN (+12%), T2 (+8%), and AFL (+3%). DON and FUM remain at high levels. Increases were due to seasonal weather variation, improved technology enhancing contamination detection abilities, increased byproduct and alternative ingredient use, and agricultural practice changes like crop rotation, less tillage, and lower fungicide usage.

In general, our historical database allows us to see that the problems related to mycotoxins will not improve in the future. It is therefore essential to adopt an effective control plan based on regular analyzes, whether they are done directly at the factory or the farm or combined with those carried out by other companies. This is exactly why Cargill wishes to share its mycotoxin database with the industry.

[Feedinfo] So, let’s look a little closer at the new species data that forms part of this year’s report. What are the top findings that you can share with us?

|

[Thomas Pecqueur] At elevated levels Mycotoxins can potentially cause many problems in livestock such as diarrhoeas, various organs lesions, abortions, mortality, etc. However, even before observing these symptoms, animals can begin to suffer from mycotoxin contamination at significantly lower levels. Generally, this results in a loss of performance which leads to a decrease in the profitability of the farm. This makes it essential to establish thresholds taking potential performance losses into account. We see it as the difference between animal safety or regulatory thresholds and our performance thresholds and share in the report, some of our mycotoxin performance thresholds for key subspecies. |

Thomas Pecqueur |

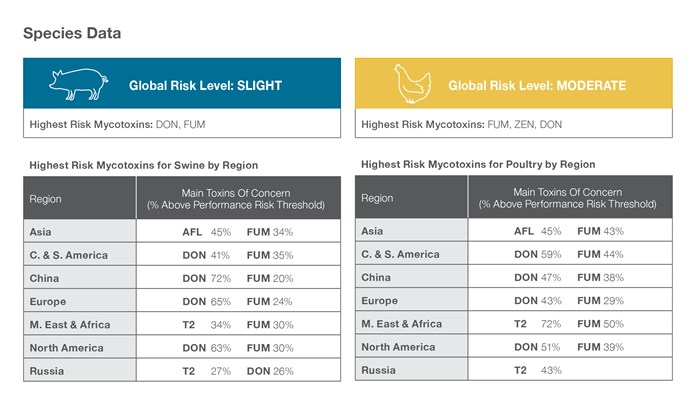

In terms of findings, our main takeaways for monogastrics include:

- FUM & ZEN are the two main mycotoxins of concern for poultry producers in most regions. Other villains are DON (China, America, Europe), T2 (MEA, Europe, NA, Russia) and AFL (mainly Asia). It is important to consider ZEN as impacting all sub species (and not only breeders or layers) and DON which can impair growth performance even with a few hundred ppb.

- Swine producers face two big villains in most regions, DON & FUM. Other villains are AFL in Asia and T2 in Russia and Africa. We recommend paying attention to ZEN levels as we are seeing an increase compared to last year. ZEN can not only impact reproduction parameters for sows, but it can lower growth performance for all pigs with severe effects when combined with other mycotoxins.

It should be noted that there may be misconceptions in the industry, like DON is only a concern for piglets and ZEN for sows. But we aim to raise awareness about the larger impacts of these mycotoxins on less noticeable production performance changes to better protect our customers’ business.

|

[Feedinfo] You are also including co-contamination data for the first time. Please explain how you went about collecting this data. How many mycotoxins did you test for? And how many were positive for 2 or 3 mycotoxins?

[Thomas Pecqueur] This was a request from our readers last year. Our data scientists were able to trace/link mycotoxin analyses with the samples. And with such strong data centralization we were able to segment the data a lot.

It’s important to note that the more mycotoxins you test for, the more you will find. This year, 92% of the 135,000 raw ingredient samples collected were contaminated with at least one mycotoxin. Of samples tested for 3 mycotoxins, 85% were positive above detection limits for 2 or 3 mycotoxins and of samples tested for 6 mycotoxins, 84% were positive for 4 or more mycotoxins.

Multi-contamination is therefore not the exception but rather the rule. Hence it is essential to properly analyze all the mycotoxins potentially present in the samples (using a contamination history such as our database, for example) and not just one or two that are thought to be the most severe in a given region.

[Feedinfo] And what insights can you share on the regional changes in mycotoxin contamination? Where are you seeing the highest mycotoxin prevalence and how does this compare to last year?

[Thomas Pecqueur] China, Asia, North America, and Europe are the areas with the highest mycotoxin prevalence and risk levels. The Middle East and Africa (MEA), Central & South America, and Russia show lower risk, though Russia (+11%) and MEA (+9%) have increased overall risk rates.

- Asia: AFL remained the highest risk in cereals and FUM in corn-based ingredients.

- Central & South America: Mycotoxins from Fusarium molds (ZEN, FUM, DON) represented significant risks for corn and cereals-based ingredients.

- China: Main concern was DON, ZEN and FUM in corn; DON and ZEN in cereals and ZEN in oilseeds.

- North America: DON remained a concern in corn and ZEN levels increased, particularly in the Northeast corn belt. FUM levels remained high in the Southern corn belt.

- Europe: DON still represented a high risk in cereals and corn-based ingredients. ZEN risk also increased in oilseeds.

- MEA: Increased overall risk with a 9% jump in the region from 2021. Strong increases in ZEN, T2, FUM, and DON, to a lower extent, particularly in corn.

- Russia: Russia remains the region with lowest mycotoxin rate; however, in 2022 we observed an 11% increase from 2021. T2, DON, & ZEN contamination rates all doubled.

[Feedinfo] Considering all of these findings, what strategies are Cargill putting forward to help farmers and feed formulators reduce their mycotoxin risk?

[Thomas Pecqueur] Proactive risk management is key to protecting animal health and maintaining productivity while mitigating mycotoxins. Success is achieved by developing informed and targeted plans that identify and anticipate mycotoxin threat levels while minimizing risk. Cargill Animal Nutrition helps customers implement the right mycotoxin mitigation strategy at the right place and right time.

Cargill has worked to better understand the various risks mycotoxins pose to animals. Many symptoms are often put forward when talking about mycotoxins but for these symptoms to appear, severe contamination is usually necessary. Moreover, when such symptoms appear, it is often too late, with the performance of animals already being drastically compromised and the financial losses more difficult to correct. It is therefore imperative to start acting before you see these symptoms.

To effectively fight against the negative effects of mycotoxins while keeping costs under control, the analysis of the ingredients used in animal feed is crucial. To do this, Cargill can make its mycotoxin analyses database available to our customers, which enables us to identify the raw materials most at risk as well as fluctuations in contamination. All this favours the adoption of an effective and cost-efficient control plan.

Cargill has also worked on a better understanding of the impacts related to mycotoxins before the clinical symptoms appear. It is commonly thought that performance is reduced with low to medium levels of mycotoxins in the feed. But thanks to multiple research studies, Cargill can estimate the performance losses expected by mycotoxin contamination and therefore estimate the related financial losses. This knowledge makes it possible to implement prudent solutions quickly in order to minimize the deleterious consequences of mycotoxins.

Published in association with Cargill Animal Nutrition