By Guillaume Milochau for Feedinfo

Feed phosphate consumption in compound feed production has declined by 58% in France over the last 20 years. In this article, Guillaume Milochau examines the evolution of feed phosphate usage in compound feed production over the past two decades and explores the question of just how low usage can go.

The French Ministry of Agriculture has provided comprehensive national statistics, offering a detailed view of French feed production over the past 20 years. These statistics include information on raw materials used in producing compound feed, mineral feed, and milk replacers collected in 2003, 2006, 2009, 2012, 2015, and 2020. The 2020 data was published in late 2022.

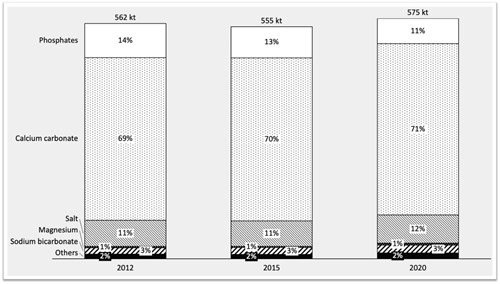

Minerals consumption in compound feed production in France (source: Agreste)

Minerals consumption in compound feed production in France (source: Agreste)

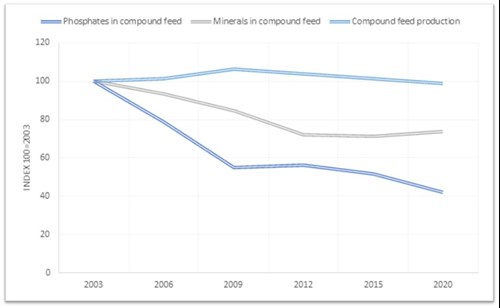

Upon initial examination, the most striking observation is the considerable decrease in phosphate usage between 2008 and 2009. Despite growing total compound feed production, there was already a trend of reduced consumption of minerals and feed phosphates from 2003 to 2006. From 2003 to 2020, feed phosphate usage in compound feed declined by 5% per year, while minerals consumption decreased by 1.8% against a backdrop of a 0.1% reduction in compound feed production. Minerals consumption is decreasing more rapidly than compound feed production. However, minerals consumption has remained relatively stable since 2012, averaging 564,000 tonnes per year in compound feed.

Feed phosphates are the only mineral category experiencing a decline; consumption of other minerals has remained stable or experienced a slight increase. The primary source of minerals in compound feed is calcium carbonate, accounting for 71% of minerals consumption. Phosphates ranked second until 2015, but in 2020 salt took this position, relegating phosphates to the third-most-essential mineral in compound feed.

It is worth noting that French compound feed production declined by 7% from 20.6 million tonnes to 19.2 million tonnes in 2022, according to the latest FEFAC publication. This decline is alarming, as French compound feed production had remained relatively stable since 2006, with an average annual output of 20.7 million tonnes.

Evolution of compound feed, minerals and phosphates production in France (source: Agreste)

Data from the past 20 years shows a 58% reduction in feed phosphate consumption in compound feed. The question now is: how low can it go?

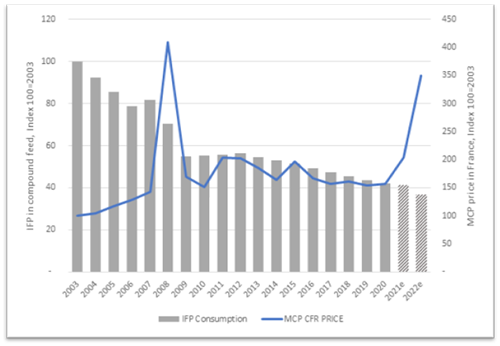

Feed producers are currently grappling with challenging market conditions. The 2022 price increase in inorganic feed phosphate (IFP), sparked by Russia's invasion of Ukraine, has forced feed producers to reconsider phosphate usage, as seen during the commodity supply crisis of 2007/2008. Based on market feedback from Feedinfo's market updates and Eurostat's trade statistics for phosphates in 2021, 2022, and early 2023, we assume that feed phosphate consumption is decreasing in Europe.

Inorganic feed phosphates consumption in compound feed in France vs MCP prices (source: Agreste 2003-2020; Eurostat 2003-2022); index 100=2003. IFP consumption for 2021 and 2022 is estimated (source: Praxed).

Utilising the French statistics from 2003 to 2020, we have estimated feed phosphate consumption for 2021 and 2022, and forecast figures for 2023. To achieve this, we collaborated with Edouard Bault, CEO and founder of FeedAccess, to estimate the impact of new-generation phytase on monogastric compound feed in Europe and the reintroduction of processed animal proteins (PAP) in Europe.

Over the next decade, meat consumption in Europe is projected to remain steady, with a slight increase in European feed production driven by growing demand for the end-product in developing countries unable to meet these needs, according to forecasts from the OECD and FAO. This trend could lead to a minor increase in IFP usage. However, the introduction of next-generation phytases is expected to cause a decline in IFP usage. The impact of phytase on available phosphorus depends on the feed's composition, with a lower-impact scenario being more likely as the transition to new-generation phytase takes time.

From July 2021, the European ban on adding animal meal to animal feed was partly repealed, allowing meat and bone meal to be used under specific conditions. This could enhance Europe's self-reliance in protein for animal feed and decrease the need for IFP. However, processed pig protein is only permitted in poultry feed, while processed poultry protein is exclusively allowed in pig feed, which introduces complexities for the industry in avoiding contamination risks. Additionally, prevailing labelling standards typically prohibit the use of meat and bone meals, and it is likely that consumers would reject the introduction of such raw materials in animal feed. This suggests that the impact of using processed animal protein will essentially be negligible.

The question thus arises: will the consumption of feed phosphates in compound feed decrease as much as it did in 2009? According to French statistics, the inclusion rate of feed phosphate in compound feed declined from 0.53% to 0.37% between 2006 and 2009. In 2020, this fell further to 0.29%. In our estimates for 2021 and 2022, we account for the reduction in feed production and assume a slight decrease in IFP incorporation in feed. If we see a repetition of historical trends, does this imply that consumption will decrease again by approximately 30%? Is this feasible?

According to research by FeedAccess, the impact of new-generation phytase, depending on the scenario, ranges from -3% to -25%. The critical determinant is the speed at which the industry capitalises on the optimal effect of phytase in feed. Another consideration is that, similar to feed phosphates, the performance of phytases varies between producers.

In a high-impact scenario, with a 25-30% reduction in consumption, it would mean formulating feed without phosphates for broilers, as suggested by phytase producers in several publications.

Of course, even with another sharp decline, the use of feed phosphates is not exclusive to compound feed production for monogastrics. Indeed, for ruminants, phosphates are mainly supplied through mineral feed.

Currently, there is no alternative to feed phosphates to meet the phosphorus needs of highly productive dairy cows or beef cattle. The use of phosphates in animal feed is not over. Still, it will undoubtedly become more and more marginal in compound feed in markets where higher use of phytase makes economic sense: specifically, regions with access to alternative feed raw material containing a higher level of phytate.

In conclusion, the French Ministry of Agriculture's comprehensive national statistics offer valuable insights into the evolution of feed phosphate usage in compound feed production over the past two decades. The data reveals a considerable decrease in feed phosphate consumption, with calcium carbonate being the primary source of minerals in compound feed.

The decline in French compound feed production is a concerning trend, and the impact of the 2022 price increase for IFP on phosphate usage is a topic of interest for feed producers. While the use of processed animal protein may increase Europe's self-reliance on protein for animal feed, prevailing labelling standards and consumer preferences are likely to limit its adoption.

The impact of next-generation phytases on feed phosphate consumption is yet to be determined, and the key determinant is the speed at which the industry capitalises on the optimal effect of phytase in feed. Nevertheless, the French statistics suggest that further reductions in feed phosphate consumption are feasible, and it remains to be seen how low it can go.

Guillaume Milochau is Economic Intelligence Consultant for agricultural commodities, chemicals, and energy for Praxed, and provides periodic insight on the phosphate and urea industries for Feedinfo. All views are his own.