31 March 2021 – Last week, Feedinfo outlined the three main derivations of alternative meats, how they are created and some of the challenges each industry has faced in recent years. In this week’s edition we will look at the success alternative meats saw in 2020, the impacts of the COVID-19 pandemic on the market, and predictions for the future of the industry with comments from Australian food futurist, Tony Hunter.

Hunter firstly confirmed that “despite all of the COVID-19 global disruption alternative proteins had a banner year both in terms of product advances and investment.”

Last year was also a headline year especially for cell-based meat (CBM) as it achieved a range of firsts in the alternative-meats industry.

Hunter, when asked about the successes alternative meats saw in 2020, told Feedinfo, “a significant 2020 milestone was the first commercial sale of cultivated meat approved by a government, with the sale of Eat Just’s chicken nuggets in Singapore. This is just one of the many product introductions taking new food technologies from science fiction to science fact.” To reach a point of commercialisation the company went through multiple rounds of funding to finance 20 production runs over two years, all supported by rigorous testing and documentation.

Further landmark moments in 2020 for plant-based meats (PBMs) came from Israeli-based Redefine Meat who debuted its 3D-printed ‘meat’ made from a combination of soy and pea proteins,” Hunter told us. And, since debuting its product in restaurants in Israel in October “they’ve raised USD 29 million Series A [funding] for commercialisation and will have products in Switzerland and Germany in mid-2021.”

Redefine is not the only company in the 3D printed alternative meat sector, “Novameats has recently developed a hybrid plant/animal fat 3D printed product which they plan to commercialise in the next few years,” he added.

Last year was also a significant year for biomass fermentation commercialisation and adoption. “Nature’s Fynd is manufacturing protein from fungi found at the bottom of volcanic springs in Yellowstone National Park,” said Hunter. “They’ve just test released their “Meatless Breakfast Patties”, which sold out within hours.”

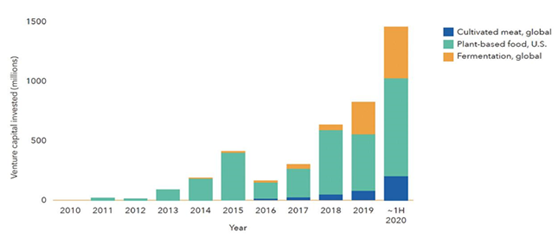

Investment in alternative protein companies was not limited to newly commercialised products in 2020, with data from the Good Food Institute showing that investment in alternative proteins in the first half of 2020 alone surpassed the total 2019 investment amount (Figure 1).

|

|

FIGURE 1. Venture capital investment trends in alternative proteins (2010–July 15, 2020). Source – Global Food Institute 2020 |

Investment in fermentation-derived proteins has also grown exponentially in recent years, from $274 million in 2019, to $435 million in the first six months of 2020. The first half of 2020 alone accounted for 85% of the all-time funding fermentation projects have received.

And it is not just alternative- meat industry leaders who are pioneering a new future for alternative proteins. Global brands are getting in on the trend before it’s too late.

McDonalds announced in 2020 it would be launching the McPlant in collaboration with Beyond Meat in 2021, while UK retailer Tesco declared it would be increasing its plant-based product sales 300% by 2025. Global food giant Unilever unveiled its plans to invest USD 1.2 billion into plant-based alternatives, while Danone declared it would triple its investment into plant-based products to USD 6.6 billion by 2025.

Impacts of COVID-19

The COVID-19 pandemic and the associated lockdowns of last year had negative effects on traditional meat industries as viral-breakouts at plants disrupted supply.

The result was that alternative meats - in particular the better-established plant-based meats - saw a meteoric rise in consumer adoption. Data from Nielsen showed that US sales of PBM increased 264% in the first 9 weeks of the pandemic and had seen a 90% rise in sales in March compared to a year earlier. Impossible Foods, who had started the year stocked at 150 US outlets, announced in May its products would now be found in 1700 Kroeger stores nationwide.

Outside of the US, research from ADM found that globally 18% of alternative-protein buyers in 2020 were buying for the first time. And that from a sample of those surveyed from the UK, Netherlands and Germany 80% would buy alternative-protein products again.

The Future of Alternative Proteins

Given the growth of alternative-proteins in the last few years most estimates expect the industry to continue to grow over the next decade as consumer adoption, improved taste and texture, reduced costs and increased supply make alternative-proteins an inviting substitute to traditional meat.

Hunter believes that alternative-meats will have improved upon the taste and texture of conventional meat by 2025 and the introduction of tailored call-based meats could further drive growth, “[we could see] cholesterol free or omega-3 enriched products that conventional meat cannot compete against,” he told us, potentially making alternative-meats more attractive than traditional counterparts.

He also said that alternative meats representing less than 1% of all meat sales is not the negative it may appear, “[the industry] is already selling products despite a major price disadvantage and as volumes grow price will decrease and they’ll sell more, so the price will decrease so they’ll sell yet more,” and he believes that widespread price parity can be expected by 2023.

If the taste, texture, and price are all comparable between traditional meats and their alternative counterparts it will be down to the consumer to drive growth in the two industries. Mr Hunter believes that alternative-meats could even surpass traditional offerings, “by 2025 plant-based meat will have been cheaper than conventional meat for a few years and that by then it will taste better than conventional meat. With the growing population there may still be room for both products, but what will consumers choose?”

The growth of alternative meats is clear, and 2020 was a standout year for the industry. One thing that is less certain is what impact its rise will have on the global traditional meat industry. Globally, demand for traditional meat is still on the rise, and is expected to continue to rise by at least 1.3% per year until 2023, according to Packaged Facts. While this figure is lower than 1% in lots of developed countries (in some cases even decreasing), it is far higher in large parts of the developing world, especially in China, where the figure is closer to 5% and shows no signs of abating, as the country’s appetite for pork and poultry in particular continues to grow.

Since 1961, meat consumption per capita in China has more than doubled from 20 kg per annum to 43 kg per person annually, while overall consumption figures are up 15-fold, in line with economic growth. There is a strong correlation between gross domestic product (GDP) and meat consumption, and it may well be a long time before developing nations move beyond traditional meat choices for health or environmental reasons.

Whatever the impact on traditional meats there is no denying that “while 2020 may have been a significant year but there’s no sign of any abatement in innovation in the category in 2021 and beyond,” Mr Hunter concluded.